Overall figure for national insurance contributors grows by 544,000 people in the last twelve months

News - 2024.2.2

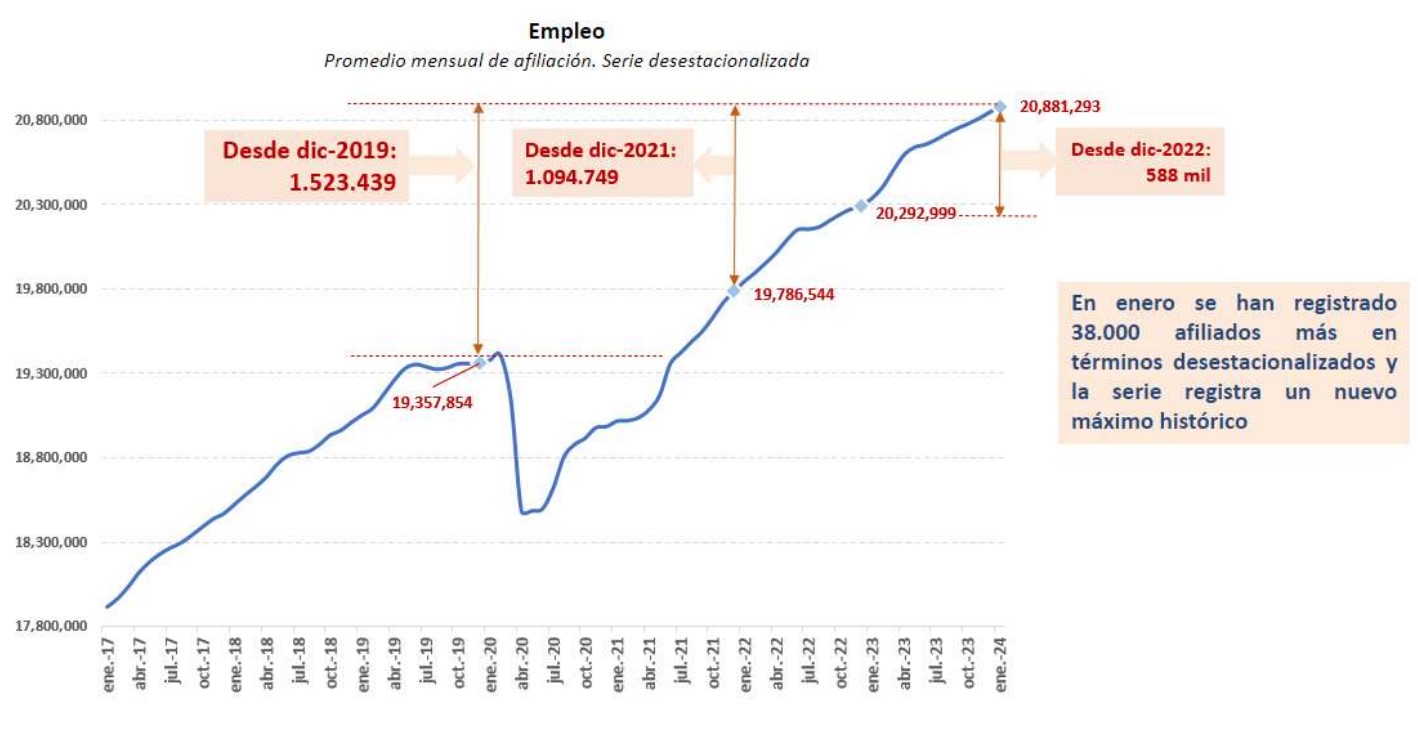

Compared to December, the increase in January was 38,357 contributors.

Average affiliation remained at record levels for a month of January, at 20,604,761. This is the highest figure in the original series for a January, despite there being 231,250 less employed people than in December. The year-on-year growth in the number of contributors was 2.6%, with 523,537 more people than in January 2023.

The good employment performance is rounded off by the growth in the number of women in employment: 9,736,376 contributors, almost 300,000 more than in January 2023. Women now account for 47.3% of all workers.

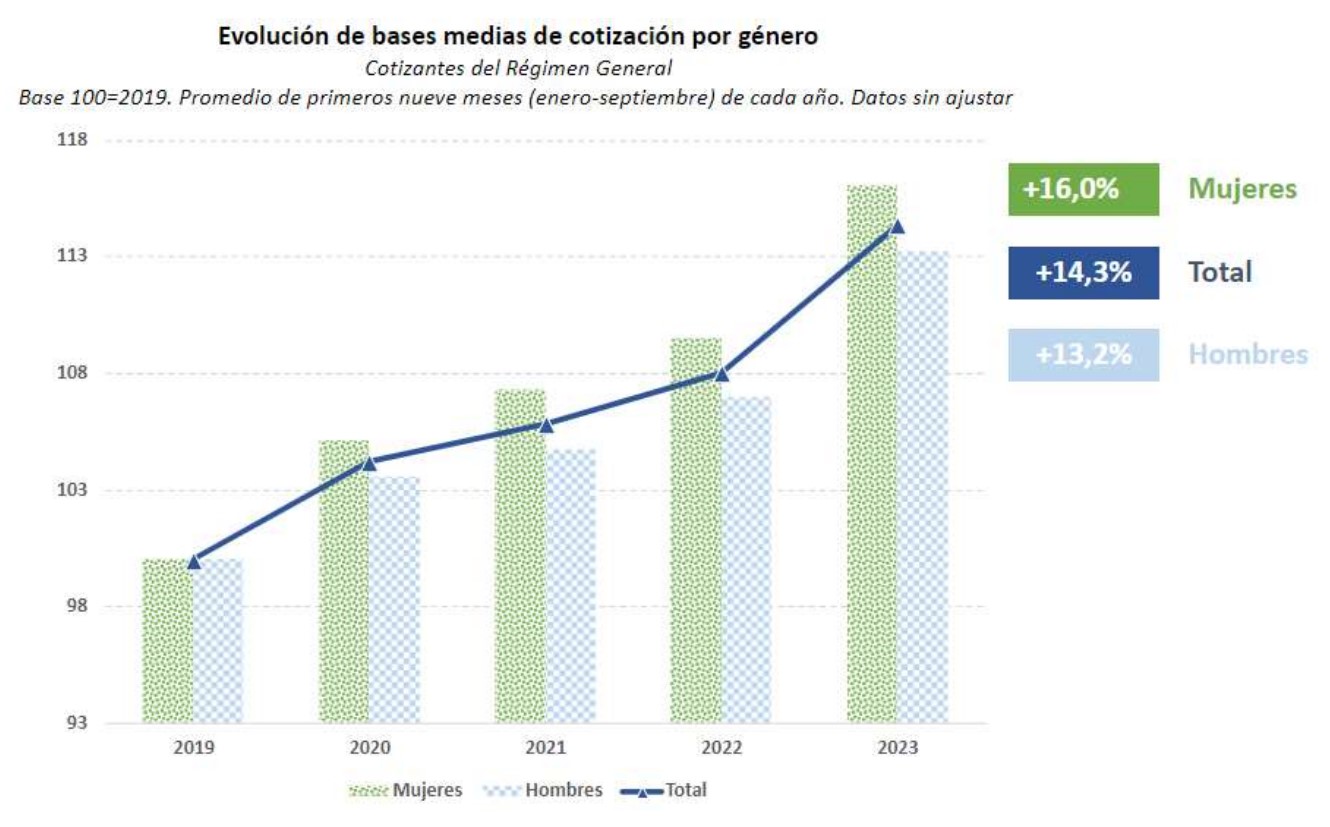

"Quantity and quality in job creation remain one of the main features of the structural change taking hold in our labour market. This behaviour is particularly noticeable among women," said Elma Saiz, Minister for Inclusion, Social Security and Migration. "There are more women working than ever before and their contribution bases are growing more than those of men. This is how we are making progress in reducing the gender gap," she added.

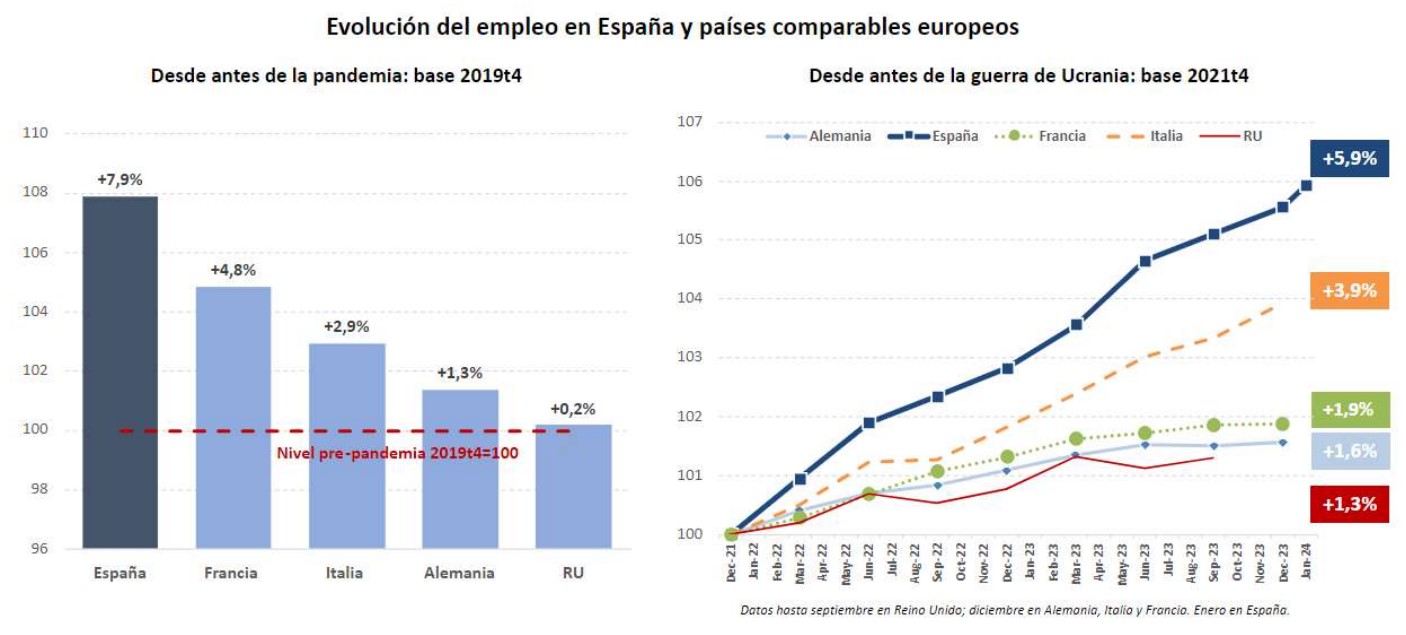

Higher employment growth than other major economies

Compared to pre-pandemic levels (December 2019), affiliation has grown by more than 1.5 million people in seasonally adjusted terms. Moreover, job creation compared to pre-pandemic levels in Spain (+7.9%) outpaced that of the major European countries (France, +4.8%; Germany, +1.3%). Employment growth since the war in Ukraine began is also comparatively higher, with Spain growing by 5.9%, while France and Germany grew less than 2%.

New all-time record for female employment

Compared to pre-pandemic levels, female employment is also particularly buoyant, growing 4 points more than that of men in the January-December average. Specifically, it increased by 11.7%, compared to the 7.6% increase in male employment. This improvement is also reflected in the evolution of contribution bases, with those of women up by 16%.

In year-on-year terms, female affiliation grew 3.1%, some 0.95 points more than that of men, and as a result there are more than 9.7 million women in work. In January, there were 9,736,379 female contributors, 47.3% of the total, which is the highest in the series.

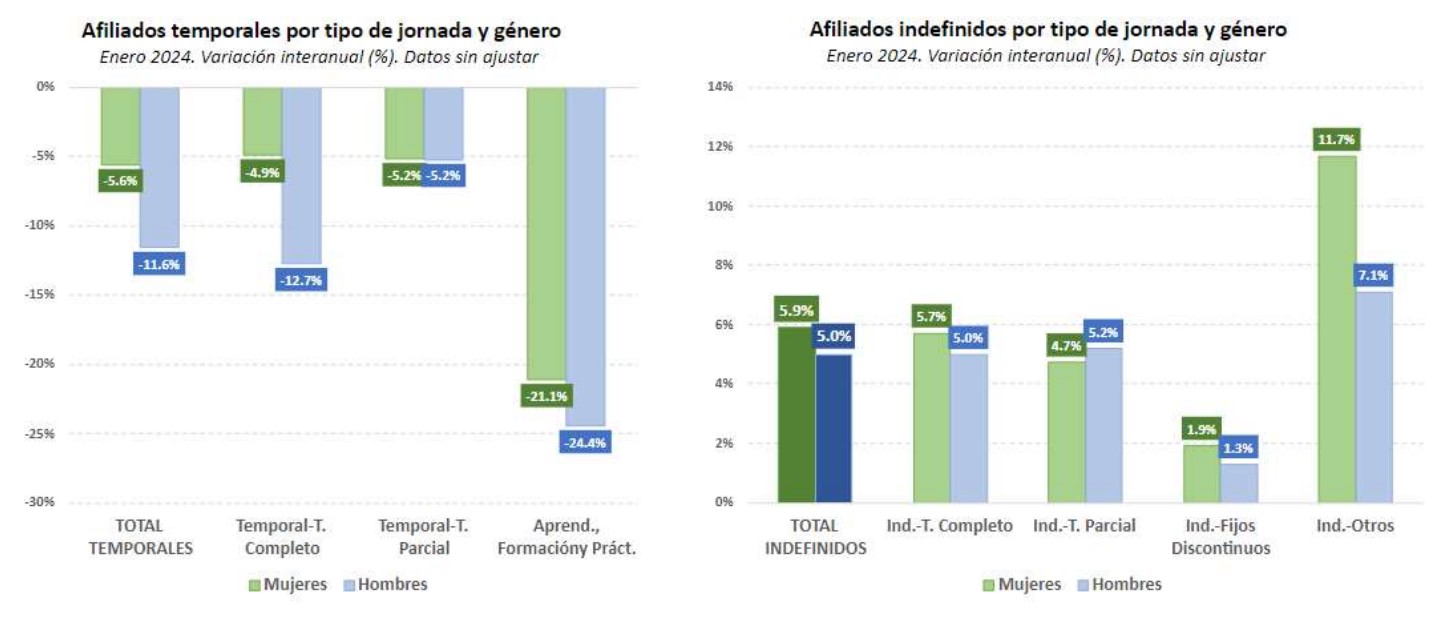

If we analyse the evolution of employment by type of contract, the increase in permanent employment among women is notable, 5.9% in the last year, higher than the figure for men (5%).

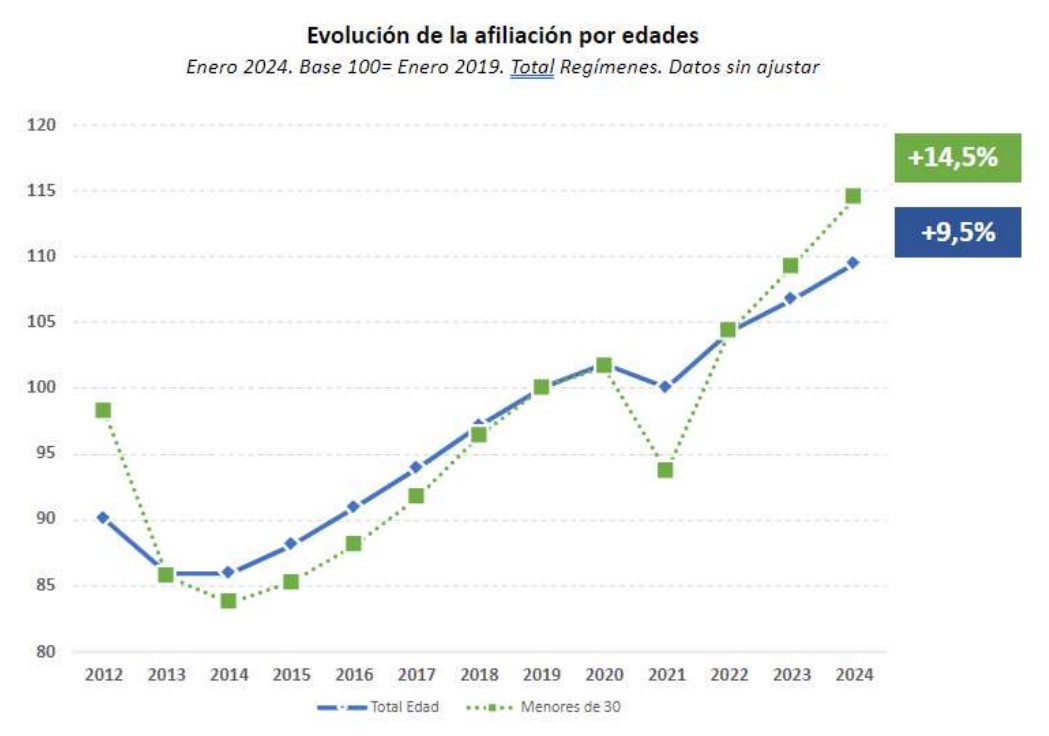

Youth employment is likewise growing above the average. Compared to the pre-pandemic level, national insurance contributors among the under-30s has increased by 14.5%, five percentage points more than the average growth rate. This growth is accentuated in sectors with high added value, such as Information Technology and Communications (51%), and Professional, Scientific and Technical Activities and Health Activities, which grew by 33.3% and 30.9%, respectively.

Employment growth compared to the pre-pandemic level is especially notable in high value-added sectors, such as Information Technology and Telecommunications, where the number of employees has grown by 25.9% compared to before the pandemic, and Professional, Scientific and Technical Activities, which has grown by 16.5%. Since the end of the pandemic, one in five new contributors (almost 325,000 in absolute terms) has joined these highly productive sectors.

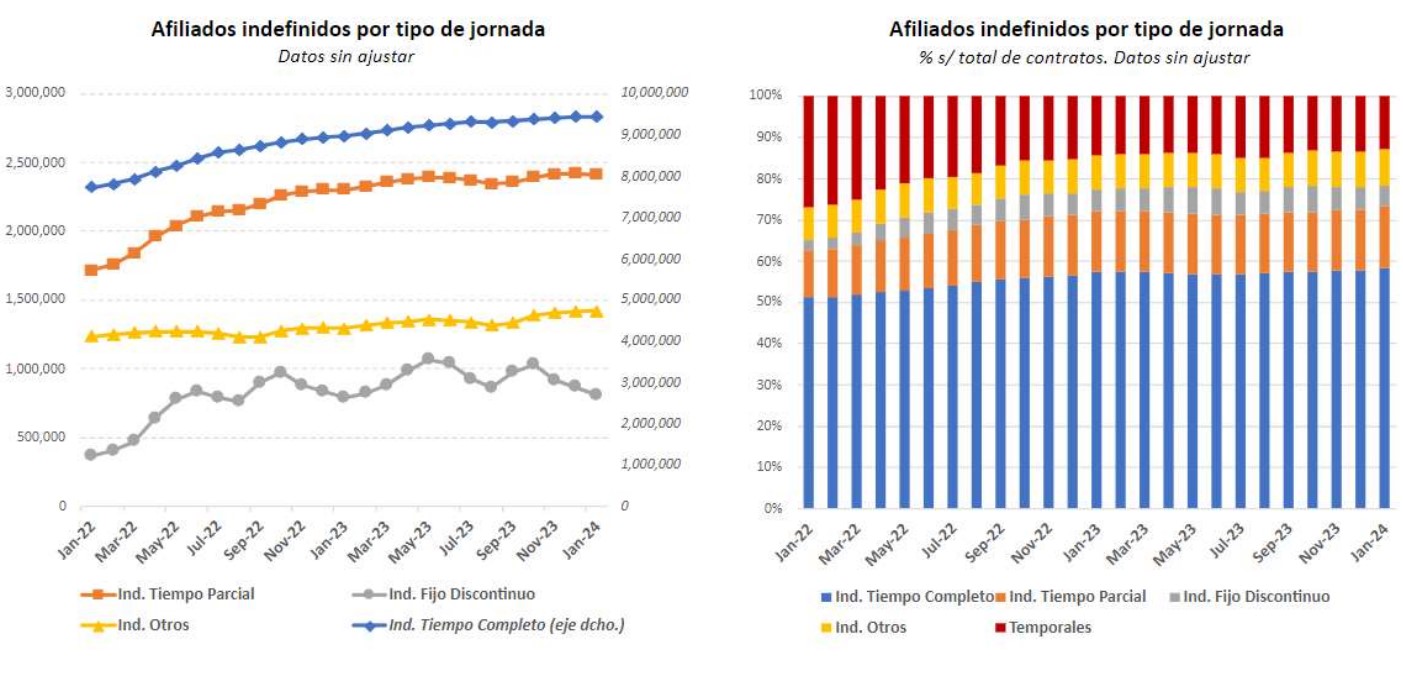

More than 3.1 million new permanent contributors and a low number of temporary contracts

Almost two years after the entry into force of the labour reform, its positive effects on stabilising employment and improving its quality can be clearly seen. Overall, there are now almost 3.1 million more contributors (3.051.345) on permanent contracts than in December 2021, the last month before the reform came into force.

Moreover, in January, the percentage of permanent contracts stood at 87%, a record high, up 17 points since the labour reform. In this regard, the temporary employment rate remains at a minimum (13%). In the case of the under-30s, the reduction in the temporary employment level is more intense, dropping by 33 percentage points (from 53% to 20%) compared to its pre-reform level.

The effects of the labour reform are also noticeable in the evolution of the number of full-time permanent contracts over the year, growing more strongly (5.3% year-on-year) than part-time contracts (4.9%) and discontinuous permanent contracts (1.7%).

Furthermore, the number of workers on ERTEs (temporary regulation of employment) remains at minimum levels, at around 11,000 people, 0.1% of all contributors.

Notable improvement in social security revenue

The strong dynamism of the labour market and the increased quality of employment is helping to strengthen the sustainability of the pension system, with revenues from social security contributions growing by 10.3% up to November (the last month for which data are available). Discounting the revenue effect of the Intergenerational Equity Mechanism (IEM), which started to be applied in January 2023, contributions are growing at a rate of 8.3%.

Non official translation